Alice Deng and Lawrence Murata were working at artificial intelligence companies when they found inspiration from their respective family’s businesses to create Slope, which enables businesses an easy way to offer buy now, pay later services.

Prior to the global pandemic, suppliers were extending net terms of 30 days to pay, but at that scale, it is hard to build up credit for small businesses, Murata told TechCrunch.

“Then with the global pandemic, the pace at which business-to-business payment was moving online was accelerating,” Murata told TechCrunch. “We wanted to bring it online at checkout and empower businesses by making access to capital easy.”

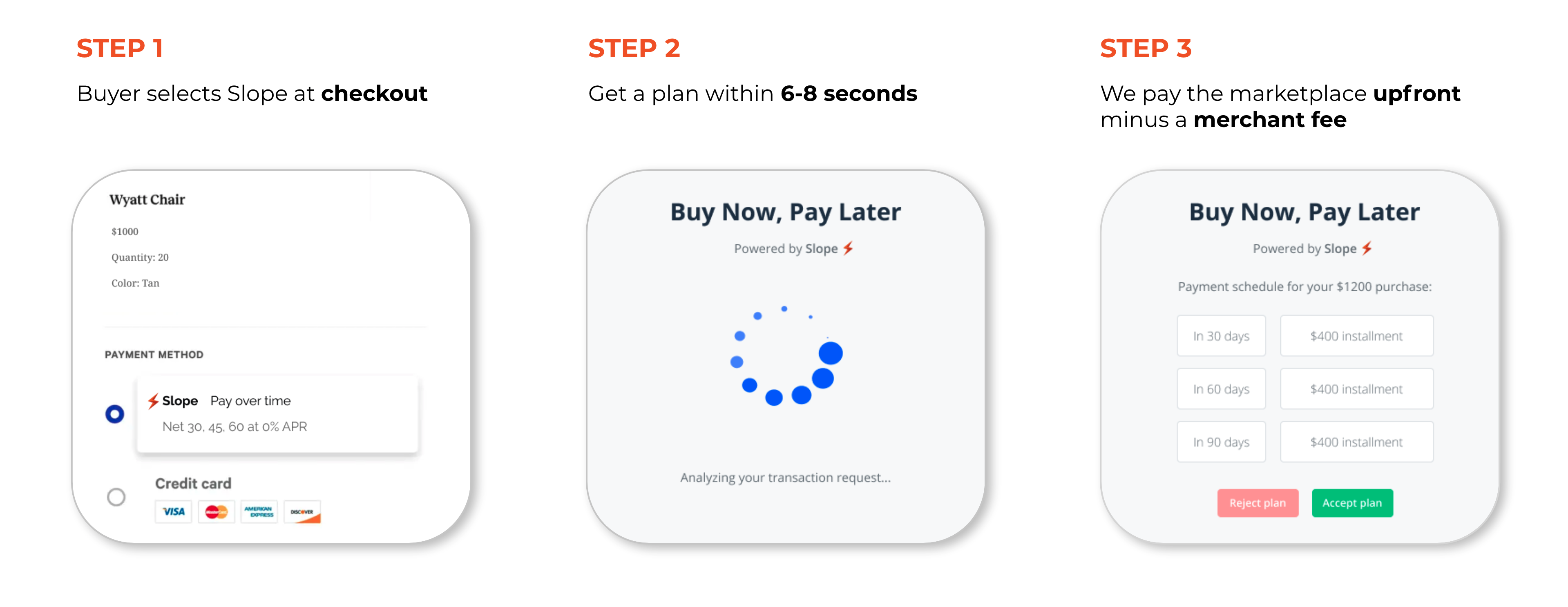

Businesses can get approved in seconds and begin offering the installments. At checkout, customers can choose the payment terms that work for them. Slope manages the lending, underwriting and any debt collection, and will pay out to the business once the product or service ships.

Slope, how it works. Image Credits: Slope

Deng and Murata are two-time Y Combinator founders, most recently attending the 2021 summer cohort. They actually went into the batch with a different company and pivoted to the business model Slope is today, launching in August.

Already, the company is growing at an incredible pace — 15 times in gross merchandise volume in just the last 30 days. In the past three months is has acquired merchant customers in the U.S., Canada, Mexico, India and Singapore. It will soon add merchants to its waitlist from China, Brazil and Europe.

Today, the company announced $8 million in seed funding from a group of backers that include Global Founders Capital and founders of Dropbox, DoorDash, Opendoor, Plaid, PlanGrid, Mercury and Pilot. The core focus for the new funding is to grow Slope’s team, build out the infrastructure for customer-centric experiences and get merchants onboarded from the waitlist.

The global B2B payments market was valued at $870 billion in 2020, with projections of reaching $1.9 trillion by 2028. At the same time, it was estimated that $127 trillion of payment flows are attributed to B2B payments, and this is expected to rise to $200 trillion, also by 2028.

“Our vision is to be Stripe for global B2B,” Deng said. “Winning in B2B requires building infrastructure and a core competency in global cross border transactions, that B2C players like Affirm and Afterpay haven’t had to grapple with.”

In addition, the co-founders interviewed hundreds of small businesses about the need for BNPL and ended up signing deals even before Slope had a product, which Deng noted was validation that this was a huge need in the market.

Don Stalter, partner at Global Founders Capital, said Slope’s growth was “impressive from the start, and one of the fastest-growing companies we have seen globally, at its stage and leanness of the team.”

Businesses have gone to banks for business loans, but it was a “janky process,” and anyone who can improve it at a rate of five times with technology will be a major disrupter, and if they can do it 100 time, they will revolutionize it, he added.

He believes Deng and Lawrence can do this by taking that big B2B payments market and attacking it with artificial intelligence and new technology that is going to improve opportunities for businesses.