Former WPP Scangroup chief executive Bharat Thakrar says he feels both betrayed and vindicated after a probe commissioned by the marketing services firm against him and ex-chief financial officer Satyabrata Das found no incriminating evidence.

The two former executives were suspended on February 19 over unspecified allegations.

They resigned as Scangroup launched the investigation, which it cited for delaying the publication of its 2020 results by four months as the external auditor Deloitte & Touche LLP waited to see if there was fraud substantial enough to alter the financial statements.

When the company finally published the results yesterday, it said that the investigation did not identify items of material nature.

The disclosure marked an anticlimax, with various stakeholders including investors trading on the Nairobi Securities Exchange(NSE) having girded themselves for bombshell revelations.

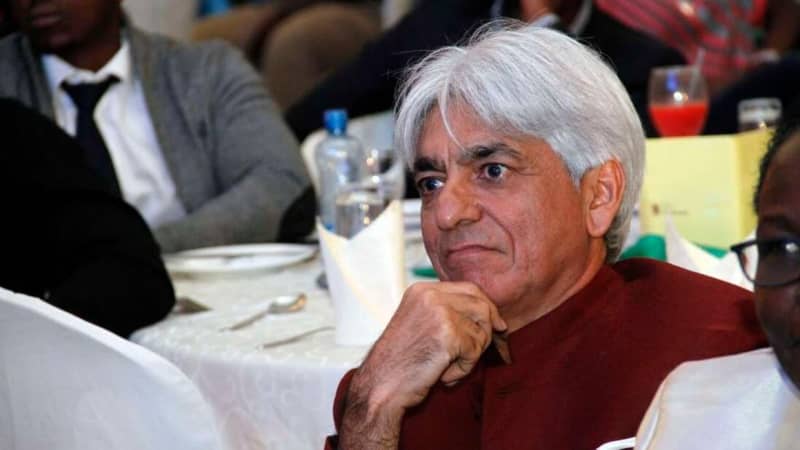

Mr Thakrar, who was the first CEO of a NSE-listed firm to be suspended or sacked publicly, says he feels betrayed by WPP Plc, the London-based multinational he brought on board to grow the company.

“The last six months have been very painful for me and my family. I feel betrayed, they have taken over my company and the company has lost its soul,” Mr Thakrar told the Business Daily.

“I am happy that I have finally been vindicated of any wrongdoing. However, the way the board chose to handle this matter is very unfortunate, especially considering that I was not just an employee but the founder and a major shareholder.”

He added that the sense of betrayal is particularly personal given that the directors who met to plot his ouster are people he nominated to the company’s board and occasionally invited into his home.

He said he retains a stake of more than 10 percent in the company, which he founded 40 years ago.

Deloitte said there was difficulty in obtaining financial information about five foreign associates of Scangroup but added that the minority investments were fully provided for years ago.

The company, however, made better disclosures in its financial statements by segregating interest income from interest expense.

Scangroup has not said whether it is open to reinstating the former executives or if it will negotiate with them to reach a settlement.

It is also not clear what amounts of money if any, the company owes the two. Mr Das, for instance, was due to receive a total of 1.2 million free shares in the marketing services firm over three years ending June 30, 2022.

Mr Thakrar’s sense of betrayal is shared by investors who sold their Scangroup shares in panic, bailing out ahead of what they expected to be revelations of significant fraud.

The share price fell steadily to lows of Sh3.5 amid uncertainty over the company’s true financial position, with the firm losing more than Sh800 million in market value since the suspension of the duo.

In a sharp reversal, the stock was the top gainer yesterday at 12.78 percent, closing at 4.06 as 1.23 million shares changed hands.

This saw the company’s market value rise by nearly Sh200 million, signalling renewed investor confidence as the fraud fears were extinguished and an opportunity to buy the shares cheaply arose.

Despite posting losses from continuing operations, Scangroup revealed that it is holding cash and bank deposits of Sh3.8 billion, which dwarfs its market capitalisation of Sh1.7 billion.

The company noted that it has won new business and reduced its cost base, setting it up for improved earnings in the coming years.

Mr Thakrar was replaced temporarily by chief operating officer Alec Graham.

Sources familiar with the saga told the Business Daily that Mr Thakrar and representatives of the company’s majority shareholder, London-based WPP Plc, had fallen out over management and strategy, including capital allocation decisions.

Mr Thakrar has for long been the face of Scangroup, which he took public on August 29, 2006, in an initial public offering (IPO) that raised Sh94 million.

He was the top shareholder at the time with a 28.53 percent stake and his holdings were at one time valued at more than Sh1 billion.

He sold his shares over the years, contributing to his ownership dropping to the current 10.6 percent.

UK-based conglomerate WPP on the other hand raised its stake in the company to a controlling 56.3 percent through a mix of share purchases and folding some of its subsidiaries into Scangroup.