The tax code contains provisions that encourage investments in the technology startup ecosystem and small businesses by rewarding founders, VCs and investors for taking high levels of risk in founding or investing in a startup. One of these provisions is the Qualified Small Business Stock (QSBS) or Section 1202 stock, which offers the opportunity to eliminate capital gains tax entirely if specific requirements are met.

It is important to note that this 100% capital gains exclusion, made permanent by the Obama administration, has been included in the draft legislation by the House Ways and Means Committee, and includes a proposed cut from 100% exclusion to a 50% exclusion for gains recognized on the sale of QSBS. For the purpose of this article, I’ll speak specifically to the 100% exclusion.

You can learn more about the QSBS rules and requirements here. One rule we discuss today is that stockholders must meet a five-year holding period to qualify. However, not everyone can time when to sell their company. The fact that many acquisitions happen before five years leaves some founders and investors short of qualifying for these powerful tax savings.

Stockholders can multiply — or “stack” — the benefit of a 1045 rollover by spreading the QSBS exclusion to more than one new investment.

Section 1045 can salvage the opportunity in some cases.

What is Section 1045?

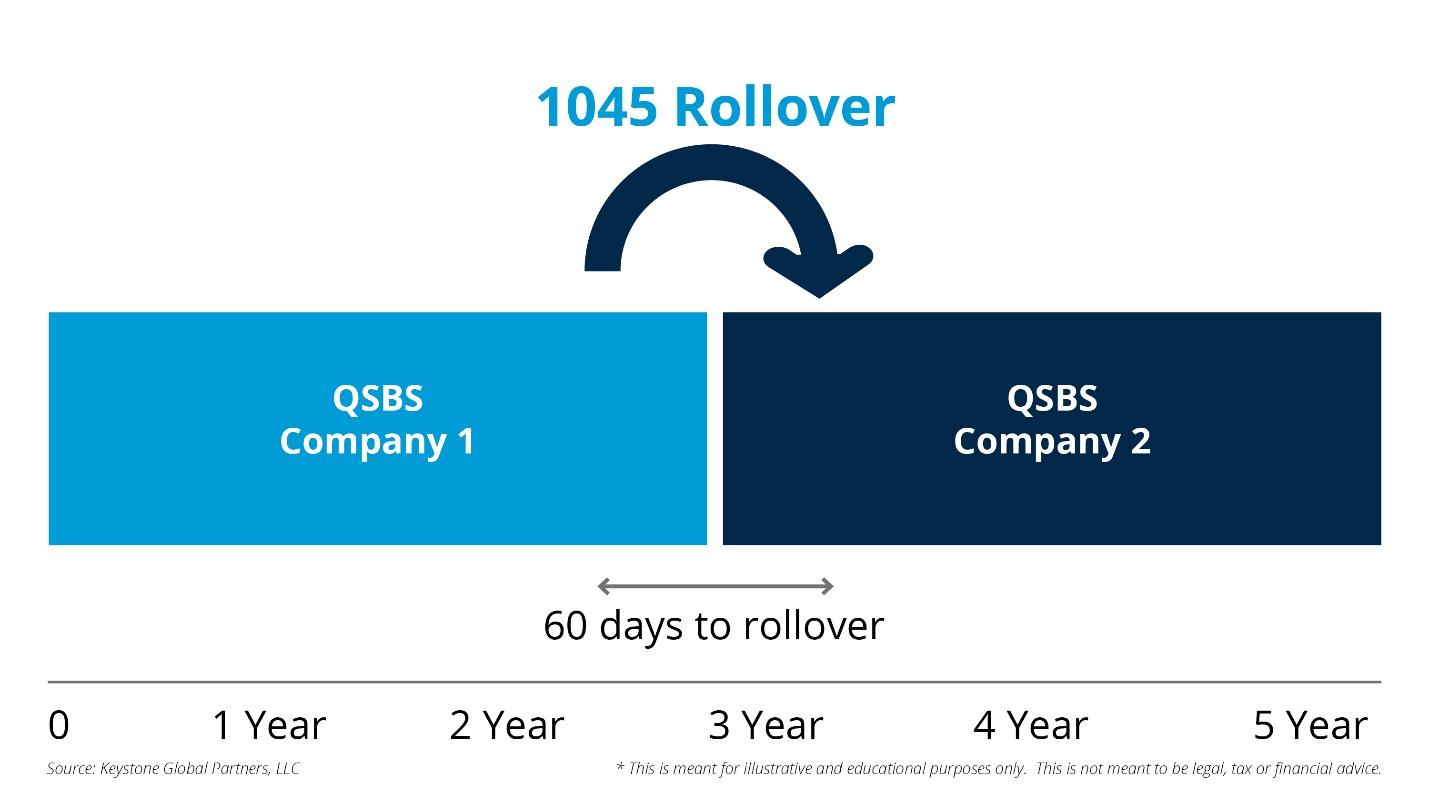

Section 1045 allows a founder or stockholder whose company has been sold before the five-year holding period to defer the capital gains by rolling the sale proceeds into a replacement QSBS.

Benefits and opportunities

A 1045 rollover enables founders and investors to take advantage of multiple tax benefits and opportunities they would otherwise miss.

Extended tax deferral

With a 1045 rollover, the stockholder can defer taxes on the sale of the original QSBS by investing in a replacement QSBS. Under the right circumstances, tax can be deferred until the replacement QSBS is sold.

If the combined holding period is five years and other requirements (discussed below) are met, no federal capital gains taxes are due. But if the requirements are not met, then taxes will be due upon the sale of the replacement QSBS.

Shortened holding period

Typically, the holding period for all taxable exchanges will begin the day after the exchange. However, the holding period for the replacement QSBS includes the holding period of the original QSBS, avoiding a reset of the five-year requirement. This means a 1045 rollover shortens the next QSBS holding period requirement and allows the clock to continue ticking.

1045 Rollover. Image Credits: Keystone Global Partners