No one’s going to tell you when your startup has reached product-market fit — there are no flashing lights, no siren, no balloons falling from the ceiling.

“Especially for first-time founders, assessing product-market fit at a stage where it’s mostly anticipation can be as much art as science,” writes News Editor Darrell Etherington, who interviewed three VCs about the topic for TechCrunch Disrupt:

- Heather Hartnett, Human Ventures

- David Thacker, Greylock

- Victoria Treyger, Felicis

“In the early days and the ideas phase, founders lean a little bit heavier into what’s happening in the world in macro and in your industry that really makes this problem,” said Treyger.

Full TechCrunch+ articles are only available to members.

Use discount code TCPLUSROUNDUP to save 20% off a one- or two-year subscription.

Thacker said entrepreneurs should be open to raising as much as possible during the concept phase to make sure they have freedom to tinker and iterate.

“I’ve seen some founders — as a VC, this is gonna sound self-serving me saying this — but I’ve seen some founders that raise way too little capital in their pre-seed round or their seed round. And they don’t give themselves enough time or enough runway to experiment.”

As with the other Disrupt recaps, there’s also a complete video of their conversation. We’re planning to post the remaining rundowns next week, so watch this space.

Thanks very much for reading TechCrunch+ this week; I hope you have a relaxing weekend.

Walter Thompson

Senior Editor, TechCrunch+

@yourprotagonist

Global startups raise $158B in Q3, an all-time record

Image Credits: sorbetto (opens in a new window) / Getty Images

This year, investors pumped a record amount of venture capital into the world’s startups: In Q2 2021, VCs invested $156 billion, upping that to $158 billion in Q3.

“The numbers are effectively a tie, meaning that we’ve just lived through the two strongest periods for investment into private companies in the history of startups,” write Anna Heim, Ryan Lawler, Mary Ann Azevedo and Alex Wilhelm.

Udemy files to go public on back of growing B2B incomes

Image Credits: Nigel Sussman (opens in a new window)

Udemy filed to go public this week in the wake of Duolingo’s successful flotation earlier this year, and Alex Wilhelm’s read of its S-1 is that the edtech firm will likely price above its final private-market valuation.

“Udemy is a somewhat stable consumer edtech offering inside a recurring-revenue B2B product,” he writes.

“If we only valued Udemy on its business revenues, at its final private-market valuation, it would be worth 4.5x its Q2 2021 ARR. That’s incredibly cheap. And its consumer business has value as well.”

After a proxy fight victory, it’s time for Box to make some bold moves

Image Credits: Box

The last few years included a delayed IPO filing and a proxy battle with a major shareholder, but events are unfolding nicely for Box co-founder and CEO Aaron Levie these days.

Enterprise reporter Ron Miller says this is “a pivotal moment for the cloud content management company,” so he interviewed Levie to learn more about his plans, particularly in light of the company’s recent revenue growth.

For balance, Ron also spoke to Alan Pelz-Sharpe, founder and principal analyst at Deep Analysis.

“The next year is pivotal for Box,” he said. “It has to prove that it was right to win the proxy fight. To do that, it has to evolve the Box platform and grow steadily but surely and continue to carve out a niche for itself in the market.”

VCs say there are more startup opportunities to chase in Latin America

Image Credits: Nigel Sussman (opens in a new window)

Ahead of Q3 venture capital numbers pouring in, Alex Wilhelm and Anna Heim tried to identify potential gaps in the funding market for Latin American startups, discovering that while more tech companies in the region are raising funds, there are still ample opportunities for intrepid investors.

Here’s who they spoke with:

- Nathan Lustig, managing partner, Magma

- Julio Vasconcellos, managing partner, Atlantico

- Antonia Rojas, partner, ALLVP

Why emerging technology founders should tackle the hardest problems first

Image Credits: Keep It 100 (opens in a new window) / Getty Images

Rebecca Bellan interviewed Sila Nano founder Gene Berdichevsky about how founders who work on emerging tech should think about scaling, should approach funding and why they should go after the hardest problem first.

“Don’t be afraid to just go for the teeth of the dragon, so to speak,” said Berdichevsky, who led the development of the Tesla Roadster’s battery pack.

“Because if you get knocked out, you can get back up and hopefully you still have the motivation to do it again.”

What Rent the Runway’s IPO filing says about the business of loaner garments

Image Credits: Nigel Sussman (opens in a new window)

As he looked at Q4’s cohort of IPO candidates, Alex Wilhelm examined Rent the Runway’s recently filed S-1 to see how well a company that offers gowns on loan has performed in an era where formal wear is more likely to mean a pair of sweatpants than a strapless Monique Lhuillier.

The pandemic has been a tough time for the company, he found. Additionally, “the gap between gross profit and gross profit excluding the cost of clothing depreciation is huge.”

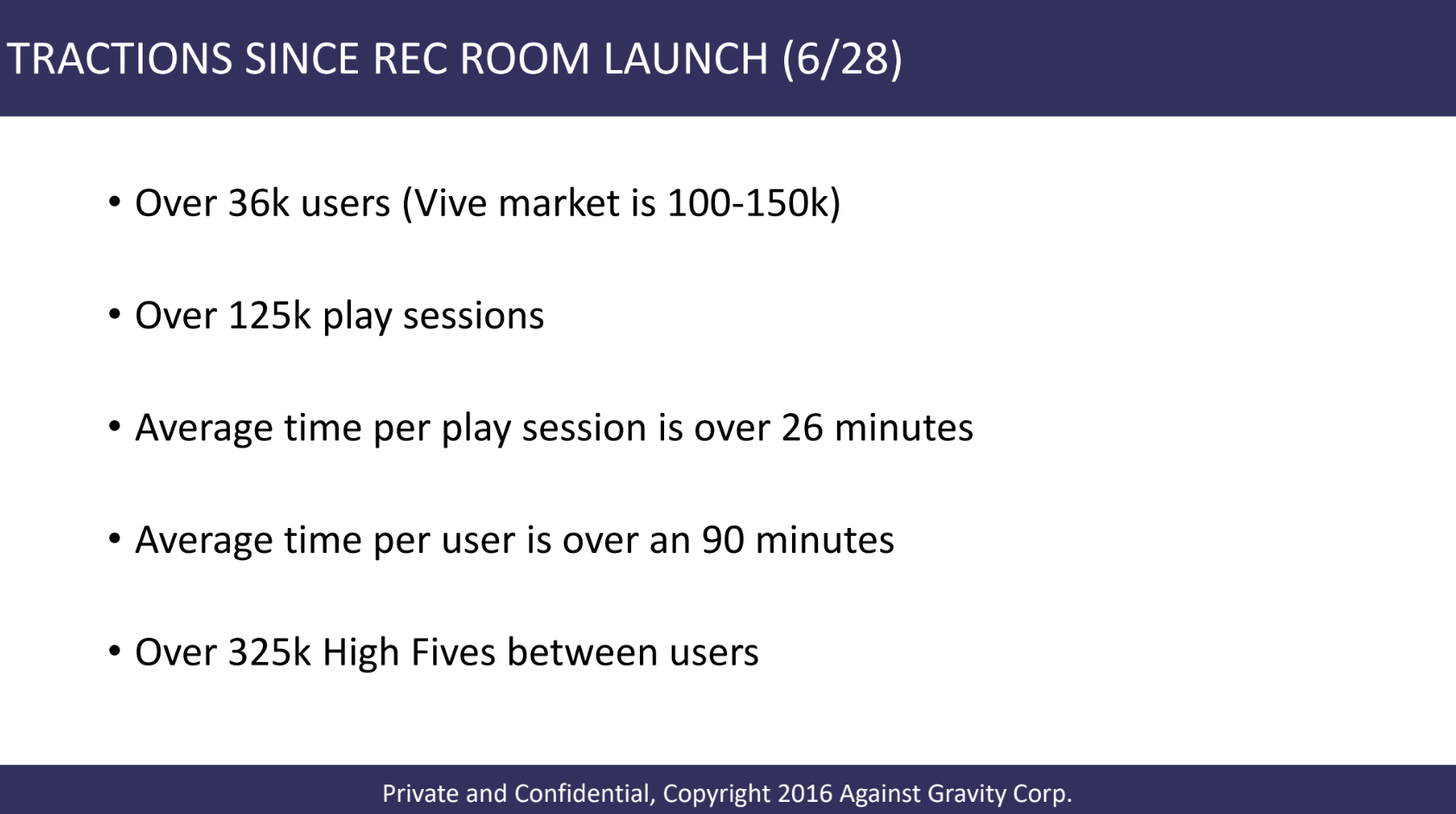

Stephanie Zhan walks through the Rec Room pitch deck that won Sequoia’s investment

Image Credits: Rec Room

In a recent episode of TechCrunch Live, Sequoia partner Stephanie Zhan reviewed the earliest pitch deck for social gaming company Rec Room with Nick Fajt, its founder and CEO.

Since Sequoia placed its bet on Rec Room, the company has raised nearly $150 million.

“I think Nick did a wonderful job of setting the tone for the type of social platform Rec Room wanted to be from the start,” said Zhan.

“What type of social identity do we want people to have? What type of interactions do we want people to be able to have? I think it’s been a huge differentiator for Rec Room from the start.”

The Athletic’s numbers look fine actually?

Image Credits: bjonesphotography (opens in a new window) / Shutterstock (opens in a new window) (Image has been modified)

After a report from The Information stating The Athletic “hemorrhaged” $100 million between 2019 and 2020 inspired lots of Twitter chatter, Alex Wilhelm studied the subscription sports media site’s publicly available metrics and failed to find much of a problem.

“A company doing nine figures of recurring subscription revenues is valuable, even if we presume that The Athletic has far lesser gross margins than your average software outfit,” he wrote.

Getting the details right in your pitch deck

Image Credits: PM Images (opens in a new window) / Getty Images

For the Pitch Deck Teardown at TechCrunch Disrupt, Managing Editor Danny Crichton reviewed two decks, “one consumer and one enterprise,” with three VCs:

- Maren Bannon, co-founder and managing partner, January Ventures

- Vanessa Larco, partner, NEA

- Ben Ling, founder and general partner, Bling Capital

Only the most exceptional pitch decks will receive more than a few minutes of attention, so Danny selected four slides “that provoked our panelists to show how VCs can have radically different views on the same material.”

Coinbase CEO Brian Armstrong might not be having fun at work, you guys

Image Credits: Nigel Sussman (opens in a new window)

Coinbase CEO Brian Armstrong posted a Twitter thread this week suggesting that the U.S. could be at risk of stifling its future CEO talent because “the number of rounds of attacks from press, politicians and trolls on CEOs (and rounds of congressional testimony) makes the job not fun.”

After reviewing Armstrong’s thoughts, Alex Wilhelm had a few of his own:

“There are a great many things to discuss in the above. As far as hot takes go, this is a collection of scorchers.”

Why Techstars is doubling down on Europe

Image Credits: Nigel Sussman (opens in a new window)

Anna Heim and Alex Wilhelm interviewed Techstars CEO Maëlle Gavet to learn more about why the accelerator is launching new European programs in Paris and one in Stockholm.

After noting that Techstars isn’t yet present in every European national capital, she said that “there is enough space for some of [those] cities to have six, seven, eight, up to 10 programs per year,” and that “there are multiple cities in Europe that [could] easily accommodate between 50 and 100 pre-seed investments by Techstars every year.”