Agora, a startup that has built a materials management platform for contractors, has raised $33 million in a Series B round of funding led by Tiger Global Management.

8VC, Tishman Speyer, Yahoo co-founder Jerry Yang, Michael Ovitz, DST, LeFrak and Kevin Hartz also participated in the financing, which brings the startup’s total raised since its 2018 inception to about $45 million.

Construction tech is one of those sectors that has not historically been considered “sexy” in a startup world that often favors glitzier technology. But construction fuels the commercial and real estate industries, which in turn impacts all of us in one way or another.

Meanwhile, the $10 trillion construction industry has long been plagued with productivity challenges. In fact, according to McKinsey, labor productivity growth in the industry has been stagnant since 1947.

Image Credits: Agora

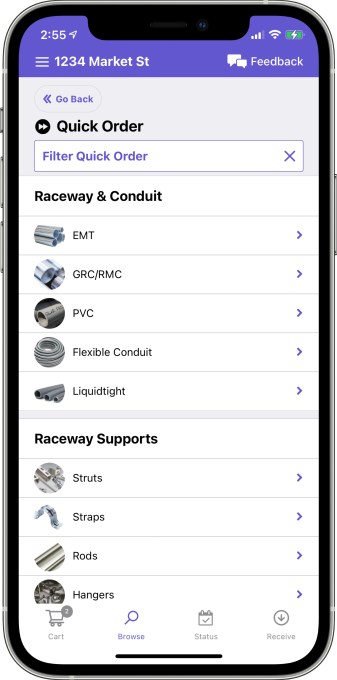

Maria Rioumine and Ryan Gibson founded Agora with the mission of making it easier for commercial trade contractors to order and track materials, automate manual data entry and give everyone involved in the procurement process a single platform by which they can communicate with each other.

The end goal is to help projects move along faster, and contractors to avoid unnecessary delays by reducing building costs. The bigger picture impact, Agora hopes, is that its SaaS platform can help make the “built environment faster and more efficient to build,” and thus help make cities “more affordable and accessible to all.”

San Francisco-based Agora is tackling the problem in a very specific, niche way that is proving to be popular both with contractors and investors alike. Rather than attempting to be a blanket solution for all trades, Agora is focusing on specific trade verticals, one by one. For example, it started out with electrical and is now moving into mechanical.

“Last year, there was more than $101 billion worth of electrical work done. Our customers work on all types of products,” Rioumine told TechCrunch. “For example, we have customers that do power stations, some that build hospitals and others that build school classrooms and university campuses, and still others that build churches and casinos. The work that these contractors do is so essential.”

Agora’s annual recurring revenue has grown 760% year over year while its customer base is up 6x during the same time frame, according to the company. It has also tripled its headcount to 45 people and today is processing $140 million in annualized materials volume for its customers.

The startup wasn’t actively raising for the Series B — instead, investors were proactively offering term sheets, Rioumine said.

“A few investors that knew us well approached us about preempting the round,” she told TechCrunch. “Twelve days after the first conversation, we had multiple term sheets.”

Tiger Global Partner John Curtius said he was drawn to Agora’s “unique” trade-specific approach.

In his view, the startup is “defining the future of procurement in construction.”

“Agora is solving a huge and critical problem,” Curtius wrote via email. “Billions of dollars a year are wasted because of inefficient procurement processes and breakages in the supply chain.”

The platform specifically does things like give contractors the ability to: customize templates, create pre-approved materials lists and easily reorder frequently needed items, order from a catalogue that offers more than 400,000 SKUs and eliminate manual data entry, which reduces errors and automates basic processes.

By bringing both field and office teams onto one digital platform, Agora claims it saves office teams 75% of the time they spend processing purchase orders, and field teams 38% of the time their foremen spend on materials management. In total, the company said its technology can provide up to $300,000 of potential annual savings for its average customer.

The company plans to use its new capital to hire across a number of teams, as well as continue to expand beyond 30 states and into other trade verticals.

“There has been this really heavy underinvestment in tech in construction for a long time,” Rioumine said. On average, the technology spend as a proportion of revenue in construction is about 1.5%, “which is actually the lowest of the industries out there where the median is 3.3%,” she added.

“So when we think about just how large this industry is and how little productivity improvements there have been recently, I think now we have this amazing opportunity to really invest in technology and bring it on to the job sites and into trade contractors’ hands.”