That the venture capital market is incredibly exuberant at the moment is not news. Data from 2021 paints the picture of a startup fundraising game at peak velocity, with more capital, unicorns and nine-figure deals than ever.

And let me tell you, some venture capitalists are tired of it. PitchBook has a post up detailing how startup prices are too high from the viewpoint of investors. That startup investment and resulting valuations may have gotten out of hand is not an unpopular perspective. Reuters’ prediction series for the new year included the idea that startups “seeking to raise capital in 2022 may [have] to sell shares at a lower valuation than before,” to flag another example.

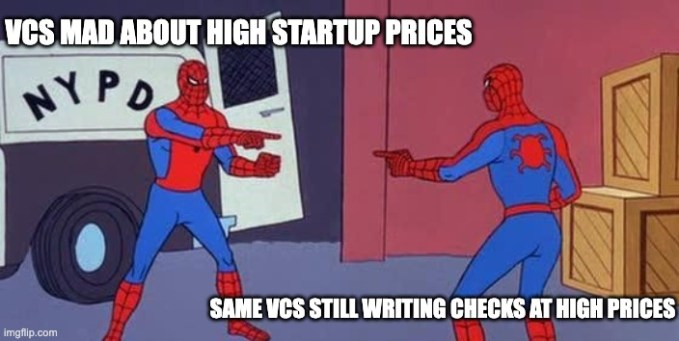

But missing from the discussion of the prices that venture capitalists and other private-market investors are paying for startup shares is the fact that they are still doing it.

This, of course, is a choice.

Venture capitalists have the ability to stop writing checks. They can hit the brakes — and quickly. We saw this in 2020 when, for several weeks while early-COVID uncertainty reigned, venture capitalists around the world started to circle the wagons around their existing portfolio companies. So, it is possible for investors to just, well, not for a bit.

If a bunch of venture investors decided to effectively go on strike, it would have an impact. And that impact would be to lessen competition, perhaps leading to lower overall startup valuations in the near term.

Will that happen? Hell no. Venture capitalists are putting capital to work at revenue multiples that even they know are elevated past reason. They are doing so because they think it is the best move from where they currently sit in the market. The game here is pretty simple: Invest the current fund, enjoy paper markups from other investors, raise an even bigger fund, repeat until your AUM makes you feel important.

This is why the complaints — and I do not mean to single out any particular investor here; most are only content to whine while off the record, I’ve noticed, so points to investors saying out loud what others are thinking — are somewhat silly to me. It’s investors complaining about their own activity.

For founders that can access more capital than ever at lower prices, godspeed. May you never find yourself in a valuation trap. But will I feel bad for the investing class? Never.