Capital Float, an Amazon-backed startup that offers its buy now, pay later service on many popular online platforms in India including that of the e-commerce firm, said on Tuesday it has raised $50 million in a new financing round following a strong growth in recent quarters.

Lightrock India led the Bangalore-based startup’s Series D financing round, which brings the seven-year-old firm’s all-time raise to over $200 million (more than half of which is in debt). Existing investors Sequoia Capital India, Ribbit Capital, Creation Investments as well as high-profile entrepreneurs David Vélez of Nubank, Kunal Shah of CRED and Amrish Rau of Pine Labs also participated in the new round.

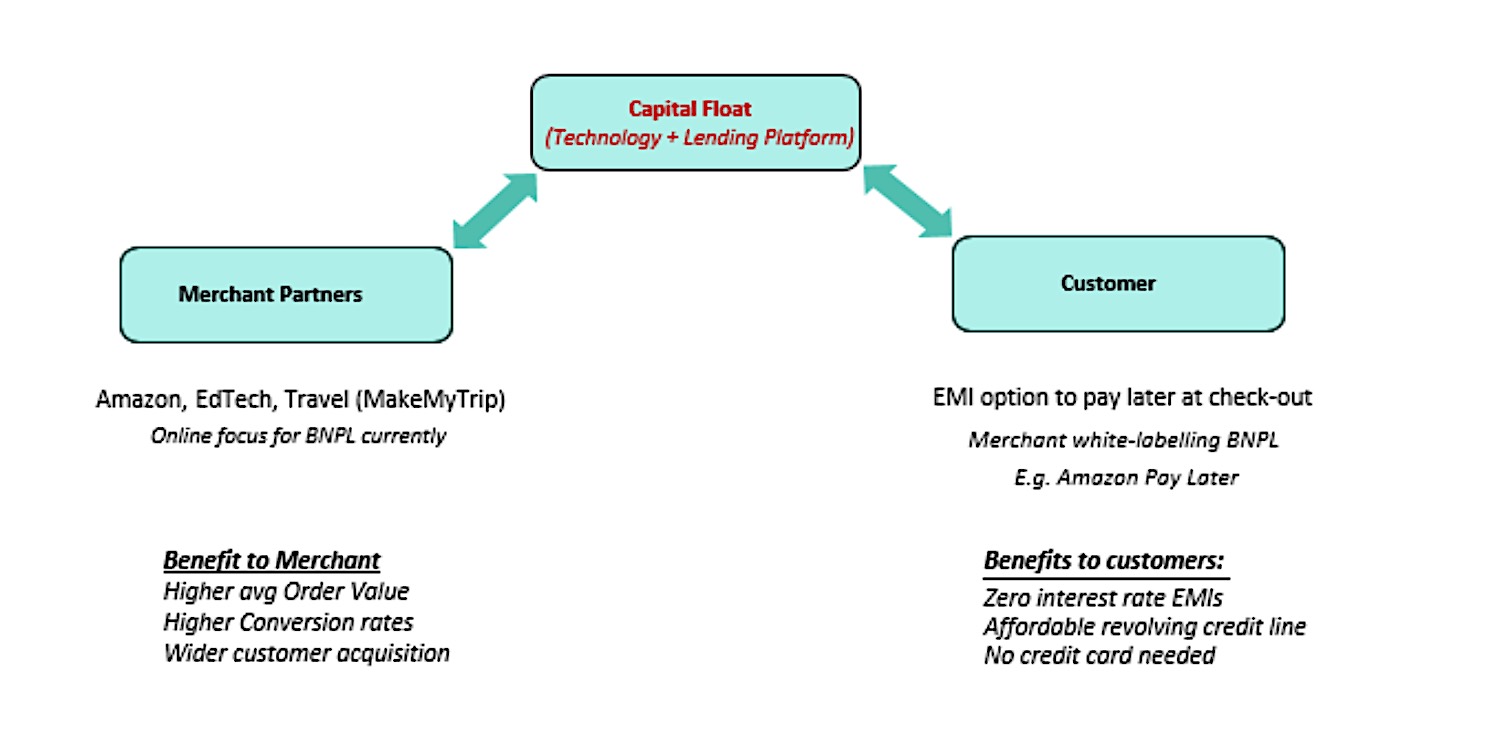

Capital Float reaches customers through partnerships with other firms. It’s a lending partner for many popular online platforms including Amazon India, online learning service Unacademy, airline Spicejet, direct-to-consumers lifestyle and electronics brand Boat and travel booking firm MakeMyTrip. Their customers can make their purchases via a loan at the time of check out, explained Sashank Rishyasringa, co-founder of the startup, in an interview with TechCrunch.

The startup also has partnerships with payments firm Razorpay to reach small and medium-sized businesses and with Walnut to offer personal finance to customers.

Capital Float has amassed over 2.5 million customers. These customers, who make over 2 million purchases a month, are using the service to finance over $271 million a year, the startup said. Most of the startup’s focus over the year has been in the online space, said Rishyasringa.

“Our customer base has more than quadrupled in the last 12 months, and our collection efficiency was still more than 95% during this period when many other firms were witnessing a drop,” he said.

Capital Float’s BNPL model. Image credits: Bernstein

The buy now, pay later market remains at a nascent stage in India, where only a fraction of the population has a credit card. But a handful of startups including Capital Float, ZestMoney and LazyPay are beginning to show traction in the market.

The low penetration of credit cards in India has meant that very few people in the nation have a traditional credit score that banks heavily rely on to establish one’s credit worthiness before issuing them a loan. Moreover, small loans don’t generate lucrative returns for banks, giving them less incentive to write such cheques.

Half of Capital Float’s user base today doesn’t have a credit card, said Rishyasringa. Capital Float, unlike many other buy now, pay later services, is a fully regulated entity. This means that the firm has to report to the credit bureaus about users’ transactions, thereby helping them with building their credit score profiles.

The startup underwrites each customer by using a range of signals. The underwriting takes place “within two clicks and five seconds,” he said.

“Capital Float has solved the unique triumvirate of customer experience, risk management, and merchant partnerships that lies at the heart of unlocking the BNPL opportunity in India. In addition to its strong technology platform, it has built a sophisticated underwriting and collections capability, along with an ethical lending playbook, that makes the model very compelling,” said Saleem Asaria, Partner at Lightrock India, in a statement.

“We have also been consistently impressed with the tenacity and execution focus of the team through a full credit cycle. We are excited to work with the team to build a highly scalable, differentiated, and sustainable business that will positively impact the lives of millions of customers in India through digital credit and financial products.”

The fresh capital, Rishyasringa said, will help the startup meet the surging growth it has seen in recent months. He attributed much of this growth to the pandemic, but also noted that there are some underlying long-term changes in consumer behavior that has helped the startup make larger inroads.

The startup, which finances the loans through partnership with banks such as Kotak and YBL, plans to also broaden its partner, he said.

“More importantly, we see an exponential growth opportunity ahead from this point on. By solving for affordability as well as convenience, in a fully-regulated format, we believe that our BNPL approach can responsibly expand access to credit to over 100 million customers who are starting to transact online. We are privileged to have the support of our investors in pursuing this vision, and are excited to work in partnership to build out a world-class digital financial institution for India,” said Rishyasringa and Capital Float’s other co-founder — Gaurav Hinduja — said in a joint statement.