Indian food delivery startup Swiggy is in talks to raise over $500 million in a new financing round that could value it at over $10 billion, two sources familiar with the matter told TechCrunch.

Atlanta-headquartered Invesco is in talks to lead — or co-lead — the new financing round in the Bangalore-based startup, which counts SoftBank Vision Fund 2, Falcon Edge Capital, and Prosus Ventures among its existing investors, sources added.

A deal has not finalized yet so the terms may change, one of them said. Swiggy had no comment on Monday. Indian news outlet CapTable first reported about the fundraise talks.

The new fundraise talks come less than three months after Swiggy finalized a $1.25 billion funding round at a post-money valuation of $5.5 billion. The startup’s chief rival in India, Zomato, had a stellar debut on Indian stock exchanges this year that paved the way for Indian consumer tech startups to explore public markets. Zomato’s market cap has surged to $14.5 billion on stock exchanges, up from $5.4 billion valuation it had attained in private markets earlier this year.

Swiggy, like its older rival Zomato, was severely hit by the pandemic. But it has recovered strongly in recent quarters, the startup said in July. The value of orders it was processing that month was 30% higher than those in the pre-COVID times, it said.

Amazon also entered the food delivery space in India last year, but, as a Zomato executive mentioned in a public forum this year, the company has yet to make inroads in this category. Amazon’s food delivery service is currently only available in Bangalore.

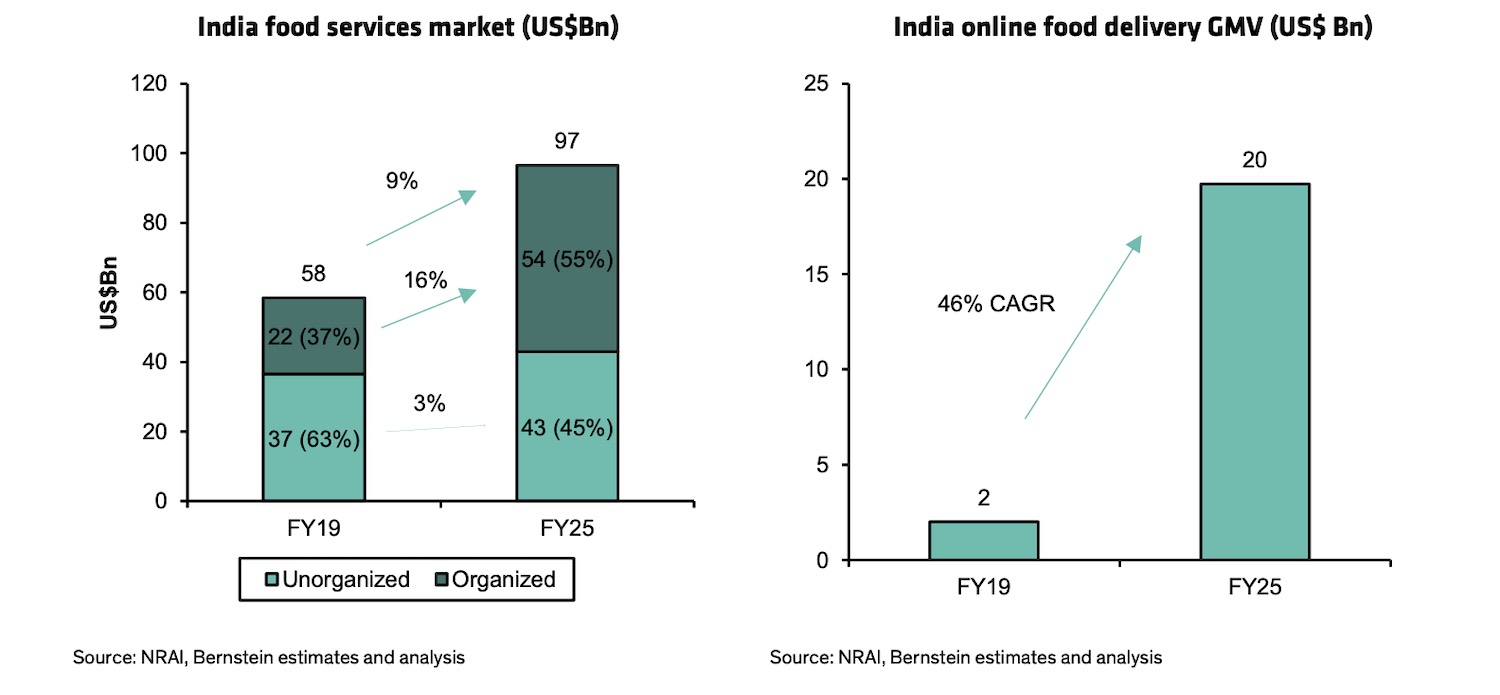

At stake is India’s food services market, which is expected to reach $97 billion by March of 2026, analysts at Bernstein wrote in a report to clients this month.

Image credits: Bernstein

“India food services market is large and expected to reach $97 billion by FY25. Organized food service is growing faster and expected to reach 55% market share by FY25. We expect online penetration to expand to 20% by FY25 and market size to reach $20 billion growing at 46% CAGR. Significant part of the growth will be driven by new customer acquisition and penetration into smaller markets. Zomato had 10 million monthly transacting users (MTU) in FY20, expected to increase 5x by FY25 to ~50 million,” they wrote.

Swiggy’s recent bet — the expansion into quick grocery delivery — has also gained traction at a time when rivals in the space (Grofers and BigBasket) have either not seen such traction or have yet to aggressively explore the space. Zomato, which invested about $100 million in Grofers earlier this year, this month shut down a pilot program where it was testing grocery deliveries.