It’s very hard to feel poorly for a company worth around $1.75 trillion, so we won’t. But shareholders of Amazon stock are taking on a bit of water in after-hours trading this afternoon. Amazon reported its Q3 2021 results today after the bell, detailing its recent performance that included a top-and-bottom miss on revenues and profits.

In the three months concluding September 30, 2021, the e-commerce and cloud computing giant reported $110.8 billion in revenues, up 15% compared to the year-ago period. Amazon also reported net income of $3.2 billion in the period, or $6.12 per share.

Analysts had expected the company to post revenues of $111.6 billion, and per-share earnings of $8.92. The company’s net income dipped by some 49% on a year-over-year basis.

Shares of Amazon are off just over 5% as we write to you this afternoon.

But while Amazon’s Q3 performance missed the mark — the company’s AWS unit did report accelerating revenue growth on a year-over-year basis, providing something for the company’s fans to crow about — its Q4 notes may overshadow its trailing results. The company’s new CEO, Andrew Jassy, said the following in the company’s earnings digest:

In the fourth quarter, we expect to incur several billion dollars of additional costs in our Consumer business as we manage through labor supply shortages, increased wage costs, global supply chain issues, and increased freight and shipping costs—all while doing whatever it takes to minimize the impact on customers and selling partners this holiday season.

The executive framed the impending costs as customer-forward, arguing that taking near-term hits for longer-term results is reasonable. Investors were not sufficiently content with the promise of future cash flows to avoid reducing the company’s market cap by a few dozen billion.

But, as we noted, it’s hard to feel that bad for the firm given that Amazon reported net income north of $1 billion per month in Q3.

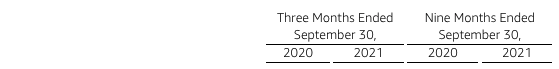

Cloud revenues are the element of Amazon earnings that we at TechCrunch pay the most attention to, so let’s peek at the data. First, here’s how the company’s AWS division performed in revenue and operating income terms:

Image Credits: Amazon

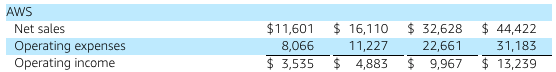

So about $4.5 billion in new year-over-year revenues, and around $1.5 billion in new operating income. For those of you curious, both AWS and revenue and operating expenses grew by around 39% in the year-over-year window. Now let’s take a closer peek at pure growth metrics:

Image Credits: Amazon

This set of data is notable because AWS is the fastest growing segment at Amazon. While the company is mostly in the headlines thanks to its e-commerce operations it is now being growth-led by its quieter cloud group. How long until investors demand that the company be split in two to unlock value?