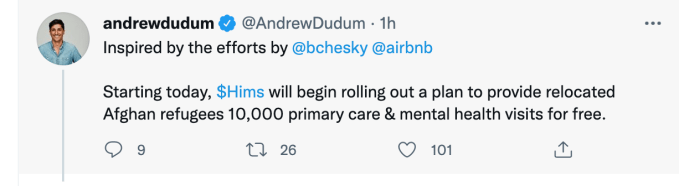

Hims & Hers co-founder and CEO Andrew Dudum said Thursday that his company is in the process of distributing 10,000 primary care and mental health visits to displaced Afghan refugees.

Founded in 2017, San Francisco-based Hims & Hers has built out a multi-specialty telehealth platform that connects consumers to licensed healthcare professionals.

In a blog post, Dudum wrote that Hims & Hers felt a “moral responsibility to act — and fast.”

He added: “The eyes and hearts of the world are currently and understandably focused on Afghanistan and the refugees evacuating en masse. These people are looking for the most basic of needs.”

Dudum said that Hims & Hers plans to work with select NGOs, nonprofits and other relevant partners, including translators and the providers on its platform, “to make sure refugees are aware of these services and get the urgent support they need.” The visits are immediately available to refugees.

The CEO also said that Hims & Hers will be covering the cost of the medical visits but that they would be “delivered by the generous providers” through its platform.

On Twitter, Dudum said the move was inspired by Airbnb CEO Brian Chesky’s recent announcement that his company planned to offer free temporary housing to 20,000 Afghan refugees around the world amid the Taliban’s rise to power in Afghanistan.

Image Credits: Twitter

The companies’ initiatives come at a time when tens of thousands of people are attempting to flee Afghanistan. Amid the crisis, companies and governments are facing increasing pressure to aid refugees fleeing the country. There are currently nearly 2.5 million registered refugees from Afghanistan, according to the United Nations High Commissioner for Refugees. As of earlier this week, countries had evacuated around 58,700 people from the country’s capital, Kabul, since mid-August.

While Hims & Hers has evolved into a telehealth platform, it also sells sexual wellness and other health products and services to millennials. The company began trading publicly in January on the NYSE after completing a reverse merger with the blank-check company Oaktree Acquisition Corp.